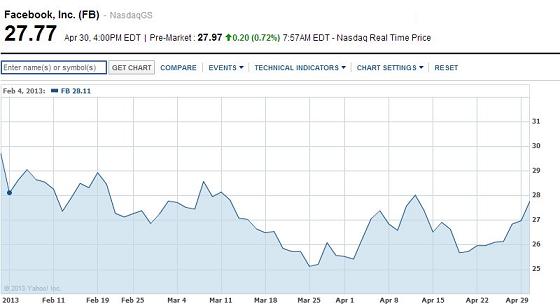

Facebook 1st quarter earnings will be announced today after the bell as analysts are focusing on revenue from mobile ad sales. The street expects Facebook to report a profit of 13 cents per share on revenue of 1.44 billion. Last quarter investors were concerned with the announcement that they were entering “investment” mode which would mean that growth of expenses would be greater than the growth of revenue as it would take time for the new investments to pay off. In fact share price was down 12% since this the end of January in response. There are similar concerns entering this current report. Still many feel that the strength of the ad revenue generated by the tremendous online social network, particularly in mobile ads make Facebook as solid long term play. One analyst upgraded the stock from outperform to strong buy based on increased revenues from new ad loads and ad formats. The stock has shown near term strength with in increase of 8% over the last month.

There is some debate regarding Facebook’s long term dominance in the sector with others such as Instagram and Google+ cutting into market share. Still most expect them to continue the main player in social ad revenue with it’s reach of over 1 billion subscribers.

Two of the best Binary Options Brokers that offer Facebook as a trading asset are 24option and TradeRush.