Based out of Toronto, Bitgold launched its services to the public keeping cryptocurrency (specifically Bitcoin) in mind as a means of exchange, but initially setting up a traditional exchange setting, allowing customers to buy gold through their bank accounts in their currency of choice. Much like Bitcoin, Bitgold’s services seek to offer an alternative to all the investment and saving features that the financial markets offer. The advantages of their services provide a safe haven from market volatility but can also be used as a means of payment, decreasing the concentration of economic power and providing an alternative for more direct trade between people.

Bitgold’s model has several clear advantages over Bitcoin. Gold is much less volatile than Bitcoin, therefore it constitutes a safer investment. It has also been ingrained in our trading traditions for centuries if not millennia, while Bitcoin is absolutely new and not based on a tangible medium. Gold may also be safer to hold than Bitcoin, since criminals seeking to steal it, will have to physically get into vaults and take it. Even if they succeed in doing so, Bitgold has a 100% insurance coverage on the gold it holds. Although some Bitcoin wallets offer insurance, it is much less common. Therefore people are more likely to understand and believe in the use of gold as a currency and as a means to preserve the value of our financial resources. Bitcoin remains an abstract idea to many.

Bitgold offers a service that solves the issue of availability, since it is an institution offering access to a commodity through traditional bank payments. The availability of Bitcoin in certain parts of the world is limited, since an established exchange and a market for the cryptocurrency must be in place to avoid using foreign currency to acquire it. Hence, Bitgold can offer the common citizen an instrument to hedge inherent risks in holding local currency, albeit in exchange for certain fees, which Bitcoin seeks to eliminate altogether.

To show this point, we can use Colombia as an example. The Colombian peso is one of the worse performing currencies in the world this year, when matched against the US Dollar and the Euro. Since the summer of 2014, the Colombian peso has lost around 45% of its value against the US Dollar, making the relative value of the savings of average Colombian citizens plummet. As of today, Bitcoin exchanges that allow an investor to buy Bitcoin by using Colombian pesos, are not fully functional, making access to Bitcoin without using an intermediary currency difficult. Bitgold on the other hand, lets you buy gold using Colombian pesos.

Given these conditions, and using a comparison between the value of gold and Colombian peso – both denominated in US Dollars – during 2015, it is possible to do a small exercise in hindsight, to show the advantages that Bitgold offers. Taking the lowest points for the value of gold in January ($1,186.00USD/oz.) and March ($1,148.00USD/oz.), and comparing them to the USD:COP exchange rate at the same point in time ($2,376.74 COP:USD in January, and $2,660.00 COP:USD in March) it would have been possible to hedge the loss in value of the Colombian peso by buying gold at those two points during the year.

Given that the exchange rate hit an all-time low of $3,238.00 COP:USD in August, and it is currently trading at around $2,900.00 COP:USD, it would have been possible to sell the USD denominated gold holdings even at a loss in US Dollar terms and still make a profit in Colombian pesos. The following calculation illustrates the hypothetical profit taking into account an investor who bought 1oz worth of gold with Colombian pesos through Bitgold in March, and sold it in August:

Buying 1oz of gold in March à $1,148.00 USD x $2,660.00 COP = $3,053,680.00 COP/oz.

Selling 1oz of gold in August à $1,085.00 USD x $3,238.00 COP = $3,513,230.00 COP/oz.

Total profit: $3,513,230.00 COP – 3,053,680.00 COP = 459,550.00 COP, or 15%.

In the period of time taken for the example above, both gold and the Colombian peso depreciated. But the Colombian currency was much more volatile than gold, and its recovery has been slow, while value of gold is much more stable relative to the Colombian peso. This shows that our hypothetical investor managed to earn a 15% return, while the peso depreciated almost 22% against the dollar. Gold depreciated about 5% over the same period of time. Still, it provided a safe haven for our hypothetical Colombian investor.

The counter argument would be to say if that investor would have known that the peso was going to depreciate against the dollar so steeply, he or she should have just bought USD and take the 22% return on the exchange rate. The difficulty with this approach is precisely an issue of accessibility, taking into account that banks and exchanges expecting the same behavior in the COP:USD exchange rate would have taken hefty premiums therefore eroding the investor’s expected profit. The middleman always profits, but with Bitgold, low fees mean that the investor keeps a larger proportion of the profit. Moreover, gold maybe a safer bet than the US Dollar, especially in the long term, since it is a coveted yet scarce commodity.

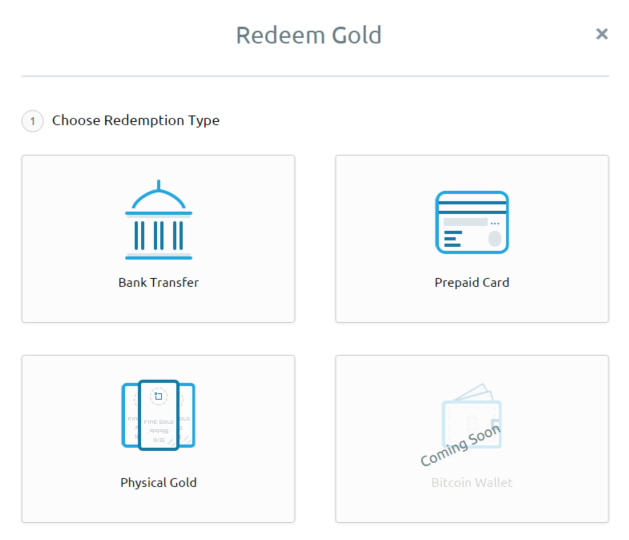

Another interesting feature that will be available shortly through Bitgold is the possibility of getting a prepaid MasterCard. If we go back to the same example of the investor in Colombia, but now we assume that he or she needs to go on a business trip to the US, a prepaid card would allow him or her to avoid exchange fees and/or banking fees while covering the expenses needed. This is a feature that Bitgold took right out of the Bitcoin play book, and applied it through traditional financial instruments.

Once Bitgold enables the Bitcoin wallet option to redeem gold and pay for gold, 3 further options will be available to the average user:

- Hedging volatility in Bitcoin without losing the flexibility that Bitcoin provides

- An additional option to convert Bitcoin to a whole host of fiat currencies without using a Bitcoin exchange

- The possibility of buying a prepaid credit card with Bitcoins by using gold as a means of exchange

Regardless of these options, the Bitgold revolution would not be on par with the Bitcoin revolution if it didn’t allow users to send invoices, and pay for goods and services by using solely gold. That is why Bitgold is developing invoices to match their payment sections in which the means of exchange can be denominated in grams of gold.

Conclusion

Some say that times of crisis generate new opportunities. Clearly the last great economic crisis in 2008 brought about the Bitcoin revolution as a decentralized means of exchange, free from middlemen, banking fees and central bank interest rate policy. Bitgold took a cue from that revolution, and fully integrated many functionality features that Bitcoin created. It is clearly a clever move that will bring back the use of commodities as currencies at least to a certain degree. It will certainly allow investors of all types to hedge the risk of holding their savings in a given currency in a secure manner. This is a great tool that promotes stability and serves to spread financial profits to smaller players. You can check it by yourself and create a Bitgold account for free.