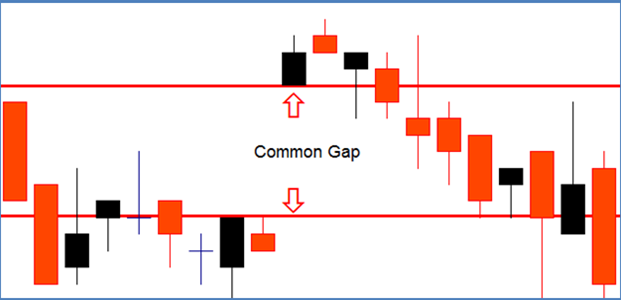

This strategy should be applied anytime the price of an asset undergoes an unexpected surge in value either upwards or downwards. Quite often you can detect when such an event has occurred because a distinctive gap will appear on the trading chart of the applicable asset, as shown on the chart below.

Þ Trader Level: Immediate

Þ Risk Level: Medium

Under such circumstances, price will then normally perform a corrective action by reverting back, or bouncing, towards its pre-gap level, as displayed on the chart above. This occurs often because over-eager investors may have generated a price spike that needs correction. When this price gap occurs may traders look for the inevitable “bounce” to occur and place trades accordingly.

How to Trade Binary Options with the Corrective Strategy

- Identifying Gap: Detect a distinctive price spike or gap of an asset on its charting chart.

- Initiate Trade: Execute a new binary option in the opposite direction of the gap once price has moved back inside it. For example, in the above diagram, a PUT option should have been executed.

Tracking economic developments over the weekend can be a lucrative study especially if you are able to identify any serious impacts on the proceedings of the previous week. If you can accomplish this objective, attempt to ascertain the primary stimuli that have created these differences. If the financial markets then open the new week displaying the expected gap, you should consider executing a new trade based on a correction strategy.

Once the price begins the process of gap-filling, this procedure seldom stops because there are no immediate supports or resistances to prevent it. This is why detecting price surges or gaps can be a profitable activity.

This corrective strategy provides quality trading opportunities exhibiting optimum profit potential at minimum risks. Note specially that although significant gaps are not created often, correction strategies are associated with a very high success rate in the order of 85%.

Want More Strategies?

For more trading strategies click here to see the full strategy library.