Hillary Clinton Coughs And The Mexican Peso Plunges

Political uncertainty in the US breeds economic uncertainty elsewhere in the globe. So when Hillary Clinton collapsed on September 11th and her physical fitness began to be the target of unprecedented public scrutiny, Trump advanced in the polls – Clinton’s ‘deplorables’ remarks also helped Trump rise. It is widely known that Trump champions an economic policy that is hostile to international trade, especially trade with Mexico. Therefore analysts arrived at the conclusion that the Mexican peso dipped to 20 per USD as a result. If true, that assertion could herald a great investment opportunity for savvy forex investors.

Political uncertainty in the US breeds economic uncertainty elsewhere in the globe. So when Hillary Clinton collapsed on September 11th and her physical fitness began to be the target of unprecedented public scrutiny, Trump advanced in the polls – Clinton’s ‘deplorables’ remarks also helped Trump rise. It is widely known that Trump champions an economic policy that is hostile to international trade, especially trade with Mexico. Therefore analysts arrived at the conclusion that the Mexican peso dipped to 20 per USD as a result. If true, that assertion could herald a great investment opportunity for savvy forex investors.

If the value of the Mexican peso is so highly correlated with the political circus in the US, then a rational decision would be to buy Mexican Pesos, understanding that Clinton still has the lead in the polls. In fact, it is Trump that has to pull a miracle off to become the 45th president of the United States of America. Therefore, the political risk of buying Mexican pesos vis-à-vis the elections in the US is still considerably low, even though it rose over the last few days. read more…

Another Fed Meeting Brings More Uncertainty Before The Elections

The Fed and the BOJ will announce their next steps on Wednesday. It is widely expected that the Fed will leave rates unchanged. According to Bloomberg only 20% of the analysts are expecting the Fed to hike interest rates. On the other side of the Pacific, the Bank of Japan – BOJ – is expected to ease monetary policy – increase money supply. According to a Reuters poll, only 60% of economists expect the BOJ to ease its policy. This leaves the market open to a wide variety of possibilities.

The Fed and the BOJ will announce their next steps on Wednesday. It is widely expected that the Fed will leave rates unchanged. According to Bloomberg only 20% of the analysts are expecting the Fed to hike interest rates. On the other side of the Pacific, the Bank of Japan – BOJ – is expected to ease monetary policy – increase money supply. According to a Reuters poll, only 60% of economists expect the BOJ to ease its policy. This leaves the market open to a wide variety of possibilities.

It is well known that the US job market has been showing signs of strength, although inflation remains below the 2% mark that the Fed has thus far said it will base its policy on. This is probably why most experts think that the Fed will not raise rates. Nevertheless the Fed held off on rate increases for the past 10 months, although the markets expected those increases to take place. Besides adding to market uncertainty, the Fed could well be setting expectations that will only be broken. read more…

Brazilian Markets Get A Boost

After months of bad news, suffering through corruption scandals, political crises and stubbornly low commodity prices, Brazilian markets finally get a breather. Although commodity prices have not recovered significantly, and the political corruption scandals still cast a long shadow over the Brazilian economy, there have been some positive news as of late that have helped the Ibovespa rise. Vale, Petrobras and Embraer are among the prominent stocks that were ticking up higher on Monday, but this can still prove to be a short lived market expansion.

After months of bad news, suffering through corruption scandals, political crises and stubbornly low commodity prices, Brazilian markets finally get a breather. Although commodity prices have not recovered significantly, and the political corruption scandals still cast a long shadow over the Brazilian economy, there have been some positive news as of late that have helped the Ibovespa rise. Vale, Petrobras and Embraer are among the prominent stocks that were ticking up higher on Monday, but this can still prove to be a short lived market expansion.

Brazil still faces multiple challenges. The economic slow-down in China, as well as the oil glut are the main international headwinds that Brazilian corporations will have to overcome. Regionally, South America as a whole displays much of the same stagnation that Brazil does. South American economies rely mainly on commodity sales to China and other industrialized countries, but the slowdown in economic growth world-wide has taken its toll. read more…

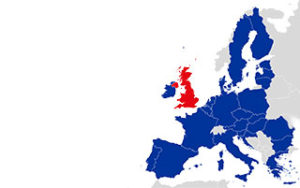

UK Job Markets Are Proving To Be Brexit-Resistant

The world heard all about the doom and gloom scenarios that analysts were painting when the outcome of the Brexit vote took markets by surprise. Up until now, none of them have really materialized, which is not a surprise given that the UK is still a full member of the EU. Nonetheless, it is surprising to see that actually since the vote took place, unemployment has gone down, and the proportion of the working age population employed, has jumped to a record high around 75% according to the BBC. This calls into question the doom and gloom scenarios, but also the overreaction that the world saw following the vote and the lack of understanding about the process that the UK and the EU must go through to finalize their Brexit agreement.

The world heard all about the doom and gloom scenarios that analysts were painting when the outcome of the Brexit vote took markets by surprise. Up until now, none of them have really materialized, which is not a surprise given that the UK is still a full member of the EU. Nonetheless, it is surprising to see that actually since the vote took place, unemployment has gone down, and the proportion of the working age population employed, has jumped to a record high around 75% according to the BBC. This calls into question the doom and gloom scenarios, but also the overreaction that the world saw following the vote and the lack of understanding about the process that the UK and the EU must go through to finalize their Brexit agreement.

read more…

CySEC: Brokers Cannot Tie Bonuses to Withdrawals

On January 22, 2013 CySEC issued a directive to their licensed CIF (Cyprus Investment Firms) regarding the granting of trading benefits (i.e. Bonuses) to clients. They reiterated their position based on a directive from 2012 that member firms cannot tie the withdrawal of deposits to achieving a specified trading volume. read more…

On January 22, 2013 CySEC issued a directive to their licensed CIF (Cyprus Investment Firms) regarding the granting of trading benefits (i.e. Bonuses) to clients. They reiterated their position based on a directive from 2012 that member firms cannot tie the withdrawal of deposits to achieving a specified trading volume. read more…

Financial Markets – Preview for Week Starting 14th August 2016

Major Events of Last Week

Hopes of a robust US economic rebound during the second half of 2016 were dented last Friday after key data indicators disclosed that American consumer confidence had slumped during July. Retail Sales missed analysts’ expectations last month amid declining consumer spending generated by Americans opting to reduce their outgoings on items, such as clothing and luxury goods. Investor mood was soured even further as receding energy and servicing costs prompted the US Producer Price Index to register its largest drop during July in practically a year. The foremost US indices produced mixed reactions last Friday demonstrated by the Dow Jones Industrial Average sliding 33 points lower; the S&P500 dropping 1 point while the NASDAQ rose by 4 points. read more…

Hopes of a robust US economic rebound during the second half of 2016 were dented last Friday after key data indicators disclosed that American consumer confidence had slumped during July. Retail Sales missed analysts’ expectations last month amid declining consumer spending generated by Americans opting to reduce their outgoings on items, such as clothing and luxury goods. Investor mood was soured even further as receding energy and servicing costs prompted the US Producer Price Index to register its largest drop during July in practically a year. The foremost US indices produced mixed reactions last Friday demonstrated by the Dow Jones Industrial Average sliding 33 points lower; the S&P500 dropping 1 point while the NASDAQ rose by 4 points. read more…

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

A Free Demo Account is the best way to practice trading. Test the trading platform and your trading strategies without risking any money.

A no deposit practice binary options account is the best way to simulate a real time trading experience. We have the most exclusive up to date list of Binary Options brokers with free demo accounts.

Sign up for our trading and options newsletter and get the latest market news and information directly to your inbox. Plus get access to the latest strategies and broker promotions before they’re published on the website!